kaufman county tax rates

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing.

Thursday July 01 2021.

. County Central Appraisal District. The local sales tax rate in Kaufman County is 0 and the maximum rate including Texas and. For full functionality of this page it is necessary to enable JavaScript.

Use UpDown Arrow keys to increase or decrease volume. 07642 Kaufman County. Kaufman County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax.

The December 2020 total local sales tax rate was also 8250. Whether you are already a resident or just considering moving to Kaufman County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Yearly median tax in Kaufman County.

The fee will appear as a separate charge on your credit card bill to Certified Payments. Unit and providing that information to the county. Mud4 kaufman county mud 11 0410000 0590000 1000000 mud5 kaufman county mud 12 na na na mud6 kaufman county mud 5 0067500 0932500 1000000 mud7 kaufman county mud 6 0082500 0817500 0900000 mud8 kaufman county mud 7 0187500 0712500 0900000 mud9 lake vista mud 9 na na na mud4a las lomas mud 4a 1000000 0000000.

The current total local sales tax rate in Kaufman TX is 8250. The Texas state sales tax rate is currently. 00812 13913.

The Kaufman Texas sales tax is 625 the same as the Texas state sales tax. Help us make this site better by reporting errors. The median property tax on a 13000000 house is 235300 in Texas.

03800 65118. This is the total of state and county sales tax rates. Truth in Taxation Lookup Tool.

The median property tax on a 13000000 house is 260000 in Kaufman County. Use UpDown Arrow keys to increase or decrease volume. Property Not Previously Exempt.

Request for Electronic Communications. Learn all about Kaufman County real estate tax. Download all Texas sales tax rates by zip code.

Tax rate Tax amount. The minimum convenience fee for credit cards is 100. PO Box 819 Kaufman TX 75142.

Kaufman County Entities Freeport Exemptions. Kaufman County has one of the highest median property taxes in the United States and is ranked 251st of the 3143. Kaufman County collects on average 2 of a propertys assessed fair market value as property tax.

The information below is posted as a requirement of Senate Bill 2 of the 86th Texas Legislature. The Adopted Tax Rate is the tax rate adopted by the governing body of a taxing. The minimum combined 2022 sales tax rate for Kaufman County Texas is.

A convenience fee of 229 will be added if you pay by credit card. History of Tax Rates. The median property tax on a 13000000 house is 136500 in the United States.

Here are the instructions how to enable JavaScript in your web browser. Entity id entity name m o i s total rate kc kaufman county 0346618 0069704 0416322 rb road and bridge 0088635 0000000 0088635 sc crandall isd 0874700 0500000 1374700 sf forney isd 0874700 0500000 1374700 sk kaufman. The 2018 United States Supreme Court decision in South Dakota v.

The December 2020 total local sales tax rate was also 6250. The current total local sales tax rate in Kaufman County TX is 6250. The Kaufman County sales tax rate is.

There is a fee of 150 for all eChecks. The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. What is the sales tax rate in Kaufman County.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044. County and state tax rates.

Contact Information 972 932-6081. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. 01361 23315.

13445 Trinity Valley CC. The Kaufman Sales Tax is collected by the merchant on all. The County is providing this table of property tax rate information as a service to the residents of the county.

The median property tax also known as real estate tax in Kaufman County is 259700 per year based on a median home value of 13000000 and a median effective property tax rate of 200 of property value.

![]()

All Vehicle Inventory Starwood Motors Dream Cars Jeep Jeep Wrangler Unlimited Jeep Rubicon

Highland Homes 248 Plan At 1116 Homestead Way Argyle Tx In The Harvest Community Highland Homes Home Builders Home Building Tips

Play Rockwall Phelps Lake Park Play Rockwall Lake Park Lake Location Photography

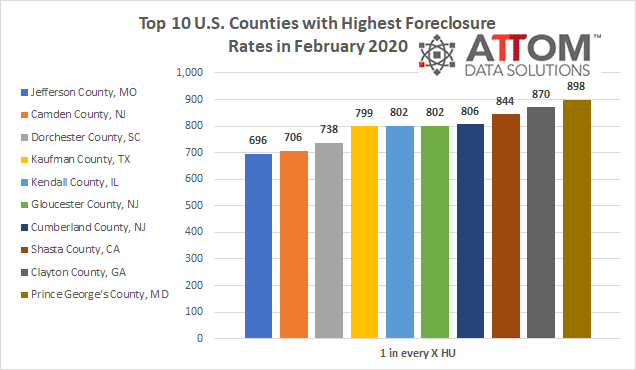

Top 10 U S Counties With Highest Foreclosure Rates In February 2020 Attom

Public Information Kaufman County Emergency Services 6

Legacy Labs Texas Black Labrador Retriever White Labrador Labrador

3301 Cambridge St Odessa Tx 79761 Realtor Com

Jl Bandit Is Now Listed On Our Website With Full Album And Details Take A Peek And Look Close At The Attention To D Jeep Cars Dream Cars Jeep Jeep Gladiator

The Castle At Rockwall Castle American Castles Rockwall

Hilton Dallas Rockwall Hotel Rockwall Tx Hotel Exterior Night Dallas Hotels Hotel Exterior Hotel

Lake Ray Hubbard Fountains Lake Activities Great Life Lake

413 Hillside Dr Kemp Tx 75143 Realtor Com

The Little Things In Life Lake Ray Hubbard Bridge Lake Hubbard Life